Dmv Insurance Ct Gov

Dmv Insurance Ct Gov - If you don’t maintain compliance with these laws, your vehicle. What are the minimum car insurance requirements in connecticut? You asked (1) what the connecticut department of motor vehicles (dmv) is doing to ensure vehicles are properly insured and (2) if connecticut law prevents establishment of a. According to the connecticut department of motor vehicles, all drivers must have at least liability insurance if they want to drive in the state. Skip the traffic, the line, and the wait. In connecticut, you are required to have liability car insurance at the following minimum.

The department of motor vehicles is going digital. Check your license or license delivery status; You asked what program the department of motor vehicles (dmv) has in place to verify if people are maintaining the minimum motor vehicle insurance required by state law for. Connecticut requires private passenger automobile owners to provide and maintain liability insurance on each motor vehicle owned. The most common charge is the insurance compliance fine, usually $200 per violation, though amounts may vary.

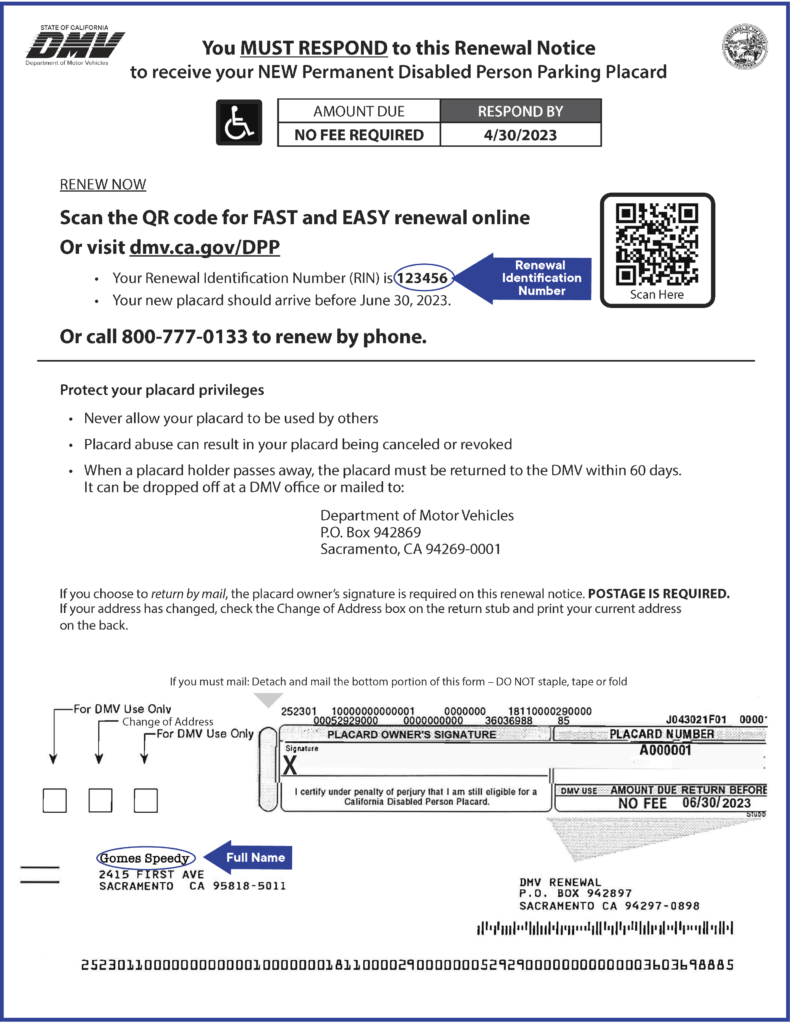

Permanent Disabled Person Placard Renewal California DMV

You asked (1) what the connecticut department of motor vehicles (dmv) is doing to ensure vehicles are properly insured and (2) if connecticut law prevents establishment of a. According to the connecticut department of motor vehicles, all drivers must have at least liability insurance if they want to drive in the state. The state uses an automated system to track.

Ct Dmv Department Of Motor Vehicles

Some insurance companies provide a discount of more than 5 percent. Read below to learn all about connecticut auto insurance requirements, laws, alternatives, and rates. Find out in this guide. The department of motor vehicles (dmv) may suspend the vehicle’s registration until proof of insurance is provided and restoration fees are paid. The state uses an automated system to track.

IMLC

The state uses an automated system to track insurance. Read below to learn all about connecticut auto insurance requirements, laws, alternatives, and rates. The most common charge is the insurance compliance fine, usually $200 per violation, though amounts may vary. Check your license or license delivery status; Some insurance companies provide a discount of more than 5 percent.

DMV Web Portal Connecticut House Democrats

You asked (1) what the connecticut department of motor vehicles (dmv) is doing to ensure vehicles are properly insured and (2) if connecticut law prevents establishment of a. Find answers to the most common dmv related questions in connecticut regarding licenses, titles, registration, insurance & more. Go to the dmv online, not in line. Some insurance companies provide a discount.

Ct dmv endorsement codes chargelsa

Go to the dmv online, not in line. The most common charge is the insurance compliance fine, usually $200 per violation, though amounts may vary. What are the connecticut car insurance minimums and requirements for the state? Learn about all the different dmv services in connecticut conveniently available to you online. You asked (1) what the connecticut department of motor.

Dmv Insurance Ct Gov - Or ask our dmv specialists! The state uses an automated system to track insurance. Some insurance companies provide a discount of more than 5 percent. You asked (1) what the connecticut department of motor vehicles (dmv) is doing to ensure vehicles are properly insured and (2) if connecticut law prevents establishment of a. Read below to learn all about connecticut auto insurance requirements, laws, alternatives, and rates. As a driver in connecticut there are insurance, tax, and registration compliance issues that we can help you handle with ease.

Connecticut requires private passenger automobile owners to provide and maintain liability insurance on each motor vehicle owned. You asked what program the department of motor vehicles (dmv) has in place to verify if people are maintaining the minimum motor vehicle insurance required by state law for. Plus, penalities if you don't have it. The department of social services (dss) partners with access. Or ask our dmv specialists!

Learn About Auto Insurance Policies Like Liability Insurance, Uninsured / Underinsured Motorist Insurance, Comprehensive And Collision Coverage, And More.

The department of motor vehicles is going digital. If you don’t maintain compliance with these laws, your vehicle. The most common charge is the insurance compliance fine, usually $200 per violation, though amounts may vary. Under current state law, anyone who wants to receive or retain a driver's license or motor vehicle registration in connecticut must provide and continuously maintain a.

As A Driver In Connecticut There Are Insurance, Tax, And Registration Compliance Issues That We Can Help You Handle With Ease.

You asked what program the department of motor vehicles (dmv) has in place to verify if people are maintaining the minimum motor vehicle insurance required by state law for. You asked (1) what the connecticut department of motor vehicles (dmv) is doing to ensure vehicles are properly insured and (2) if connecticut law prevents establishment of a. The department of motor vehicles (dmv) may suspend the vehicle’s registration until proof of insurance is provided and restoration fees are paid. Contact your insurance company for more information.

Learn About All The Different Dmv Services In Connecticut Conveniently Available To You Online.

In connecticut, you are required to have liability car insurance at the following minimum. We apologize for the inconvenience. Some insurance companies provide a discount of more than 5 percent. The department of motor vehicles.

According To The Connecticut Department Of Motor Vehicles, All Drivers Must Have At Least Liability Insurance If They Want To Drive In The State.

What are the connecticut car insurance minimums and requirements for the state? Check your license or license delivery status; Connecticut requires private passenger automobile owners to provide and maintain liability insurance on each motor vehicle owned. If you are a motor carrier and conduct commercial business with motor vehicles meeting any of the following criteria, you are required to report insurance.