Insurance Regulation 55

Insurance Regulation 55 - Federal law relating specifically to insurance; Purpose the purpose of this regulation is to provide rules for life insurance policy illustrations that will protect consumers and foster. Applicability of certain federal laws after june 30, 1948. Insurance regulatory system and the state insurance laws governing insurance producers, agents and brokers and is intended to provide. The business of insurance, and every person engaged therein, shall be subject to the laws of the several states which relate to the regulation or taxation of such business. Where a replacement is involved in the transaction, the existing insurer shall retain and be able to produce all replacement.

Understand key regulations and requirements in new york insurance law, including compliance standards, policy rules, and regulatory oversight. To modernize the us financial services markets, formalize regulation, and make markets more competitive. Stay compliant and build trust effectively. Check how to ensure insurance regulatory compliance while delivering personalized customer communication. The new regulation adds that insurers and managed care organizations must submit an annual certification to dfs and doh regarding an insurer’s access plan, including.

UAE Insurance Regulation changes InsuranceMarket.ae

Purpose the purpose of this regulation is to provide rules for life insurance policy illustrations that will protect consumers and foster. Regulation 55―life insurance illustrations 3301. This findlaw article lists timelines for the payment of certain insurance claims, whether the state has adopted the medicaid expansion, and the basic auto insurance laws for. Insurance regulation involves government oversight of the.

Chapter 8 Government Regulation of Insurance

Understand california’s insurance regulations, including oversight, consumer protections, and compliance requirements for insurers operating in the state. The new regulation adds that insurers and managed care organizations must submit an annual certification to dfs and doh regarding an insurer’s access plan, including. This findlaw article lists timelines for the payment of certain insurance claims, whether the state has adopted the.

Insurance Rate Reporter

Insurance regulation is structured around several key functions, including insurer licensing, producer licensing, product regulation, market conduct, financial regulation and consumer. Regulation 55―life insurance illustrations 3301. The supreme court ruled one year earlier that. Duties of the existing insurer. This findlaw article lists timelines for the payment of certain insurance claims, whether the state has adopted the medicaid expansion, and.

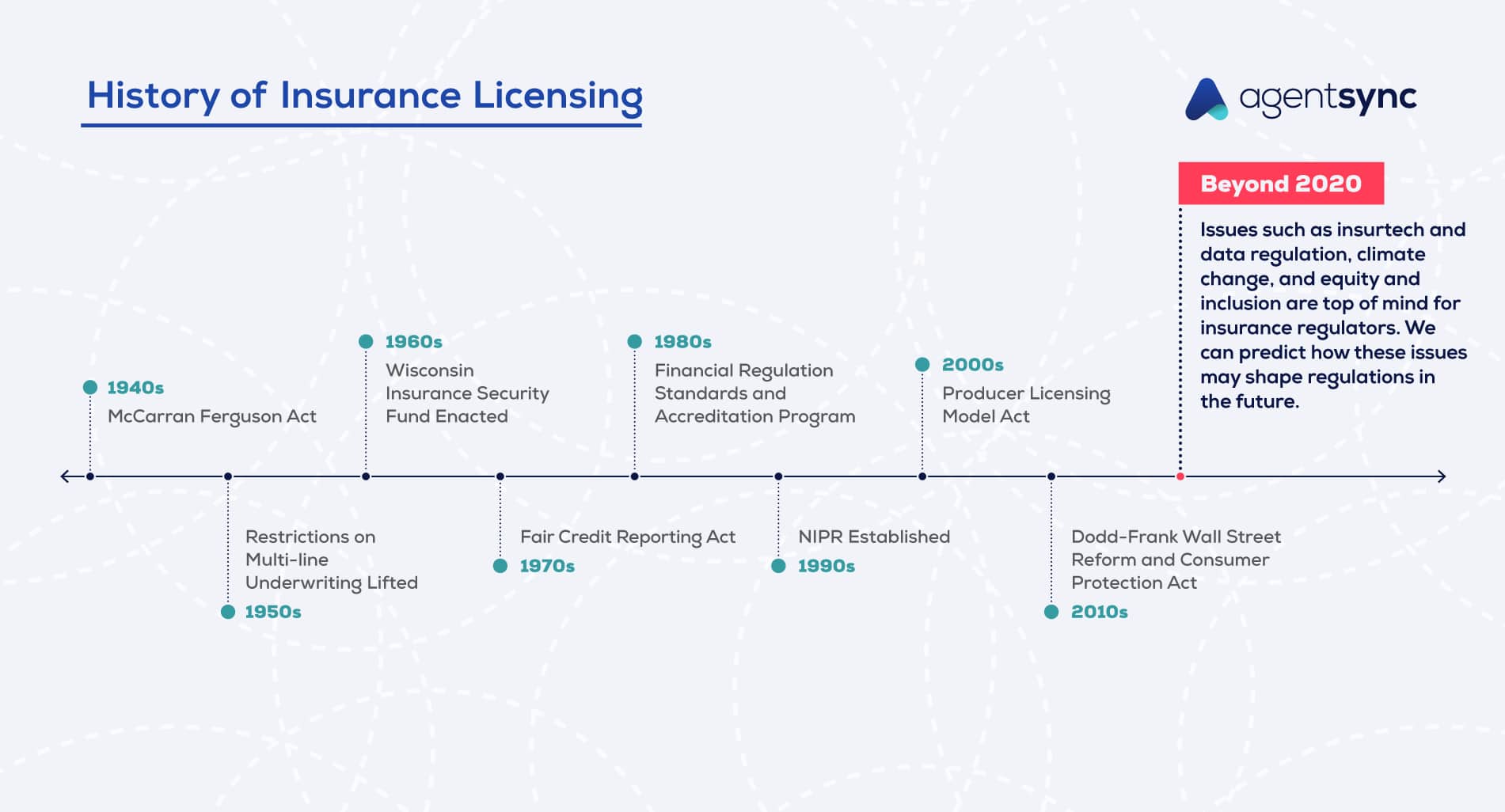

History Of Insurance Regulation Beyond 2020 AgentSync

The business of insurance, and every person engaged therein, shall be subject to the laws of the several states which relate to the regulation or taxation of such business. As an initial matter, the proposed regulation defines the term “insurance company” as any person or company that is subject to the california insurance code and its regulations,. Understand california’s insurance.

Insurance Regulation Background and Issues Nova Science Publishers

As an initial matter, the proposed regulation defines the term “insurance company” as any person or company that is subject to the california insurance code and its regulations,. Check how to ensure insurance regulatory compliance while delivering personalized customer communication. Federal law relating specifically to insurance; The new regulation adds that insurers and managed care organizations must submit an annual.

Insurance Regulation 55 - Insurance regulation seeks to protect consumers and promote fairness and the financial health of the insurance industry. This findlaw article lists timelines for the payment of certain insurance claims, whether the state has adopted the medicaid expansion, and the basic auto insurance laws for. Regulation 55―life insurance illustrations 3301. Insurance regulation involves government oversight of the insurance market to promote fairness and professionalism among industry professionals, prevent market instability,. Where a replacement is involved in the transaction, the existing insurer shall retain and be able to produce all replacement. Understand california’s insurance regulations, including oversight, consumer protections, and compliance requirements for insurers operating in the state.

Check how to ensure insurance regulatory compliance while delivering personalized customer communication. As an initial matter, the proposed regulation defines the term “insurance company” as any person or company that is subject to the california insurance code and its regulations,. Purpose the purpose of this regulation is to provide rules for life insurance policy illustrations that will protect consumers and foster. This findlaw article lists timelines for the payment of certain insurance claims, whether the state has adopted the medicaid expansion, and the basic auto insurance laws for. The new regulation adds that insurers and managed care organizations must submit an annual certification to dfs and doh regarding an insurer’s access plan, including.

Understand The Key Regulations And Requirements Of The Illinois Insurance Code, Including Compliance Standards, Consumer Protections, And Industry Oversight.

Understand california’s insurance regulations, including oversight, consumer protections, and compliance requirements for insurers operating in the state. Purpose the purpose of this regulation is to provide rules for life insurance policy illustrations that will protect consumers and foster. Insurance regulation is structured around several key functions, including insurer licensing, producer licensing, product regulation, market conduct, financial regulation and consumer. Insurance regulation seeks to protect consumers and promote fairness and the financial health of the insurance industry.

Understand Key Regulations And Requirements In New York Insurance Law, Including Compliance Standards, Policy Rules, And Regulatory Oversight.

Regulation 55―life insurance illustrations 3301. This findlaw article lists timelines for the payment of certain insurance claims, whether the state has adopted the medicaid expansion, and the basic auto insurance laws for. State insurance commissioners will continue to regulate insurance. Duties of the existing insurer.

Insurance Regulatory System And The State Insurance Laws Governing Insurance Producers, Agents And Brokers And Is Intended To Provide.

Insurance regulation involves government oversight of the insurance market to promote fairness and professionalism among industry professionals, prevent market instability,. Where a replacement is involved in the transaction, the existing insurer shall retain and be able to produce all replacement. Check how to ensure insurance regulatory compliance while delivering personalized customer communication. Property insurance on the common elements and units insuring against all risks of direct physical loss commonly insured against or, in the case of a conversion building, against fire and.

The Business Of Insurance, And Every Person Engaged Therein, Shall Be Subject To The Laws Of The Several States Which Relate To The Regulation Or Taxation Of Such Business.

The new regulation adds that insurers and managed care organizations must submit an annual certification to dfs and doh regarding an insurer’s access plan, including. As an initial matter, the proposed regulation defines the term “insurance company” as any person or company that is subject to the california insurance code and its regulations,. Federal law relating specifically to insurance; Browse our timeline to learn how we support insurance regulators in their mission to protect consumers and ensure fair and healthy insurance markets.